One of the vital facets influencing a mortgage business’ efficiency is the choice of the appropriate CRM software. It can be quite challenging to manage customer relationships for your mortgage business. With the choice of the appropriate mortgage CRM software, you benefit from improved customer relationships, streamlined processes, and enhanced productivity. Right from data security to customization, various factors contribute to your decision. Let’s first get an overview of the meaning of CRM mortgage software and then understand the details of the factors impacting the selection.

Mortgage CRM software: Overview

Financial institutions use mortgage CRM as the process to consolidate customer data and determine the position of the borrowers in the lending process. In this context, CRM software serves as a digital tool used by mortgage brokers and loan officers to accomplish this process. Mortgage CRM Software assists lenders in tracking client relationships from initial contact to signing a mortgage. Also, it can streamline your marketing efforts, team productivity, and customer experience. With a myriad of CRM mortgage options to opt from, let’s know the key factors to consider.

How to Choose New Mortgage CRM Software?

1) Define your goals

Firstly, you need to clarify your mortgage business goals. Ask yourself whether your mortgage business is chiefly focused on customer communication or the use of marketing tools or a self-service portal. You must clarify your needs and the needs of your customers to easily recognize the software features valuable for your business. Once you have evaluated your goals, you can go through the features of different mortgage CRM systems and then make a wise decision.

2) Customer relationships

The mortgage industry is primarily focused on building and maintaining relationships with customers. Your chosen CRM mortgage platform must let you deliver customer service as expected by your customers. Here are some parameters that help with relationship building:

- Deal flow management

- Business intelligence and reporting

- Client document portal

- Synchronization of email, contact, and task

- Automatic digital communication

- Tasks management

Considering these facets helps your business maintain flawless communication with your clients. Besides, mortgage websites can also effectively contribute to attracting new clients. You can book a demo from us to acquire an understanding of how to choose mortgage CRM software.

3) Efficient marketing capabilities

A reliable mortgage broker CRM can ensure successful marketing campaigns and business growth. Choose one of the effective mortgage CRM systems that incorporate a mortgage calculator, search engine optimization modules, integration of social media, and content management interface. Marketing is an inevitable facet and many mortgage businesses don’t have sufficient time to dedicate or appropriate means to outsource. Using mortgage CRM software with exceptional marketing capabilities can help your mortgage business stand out in the market.

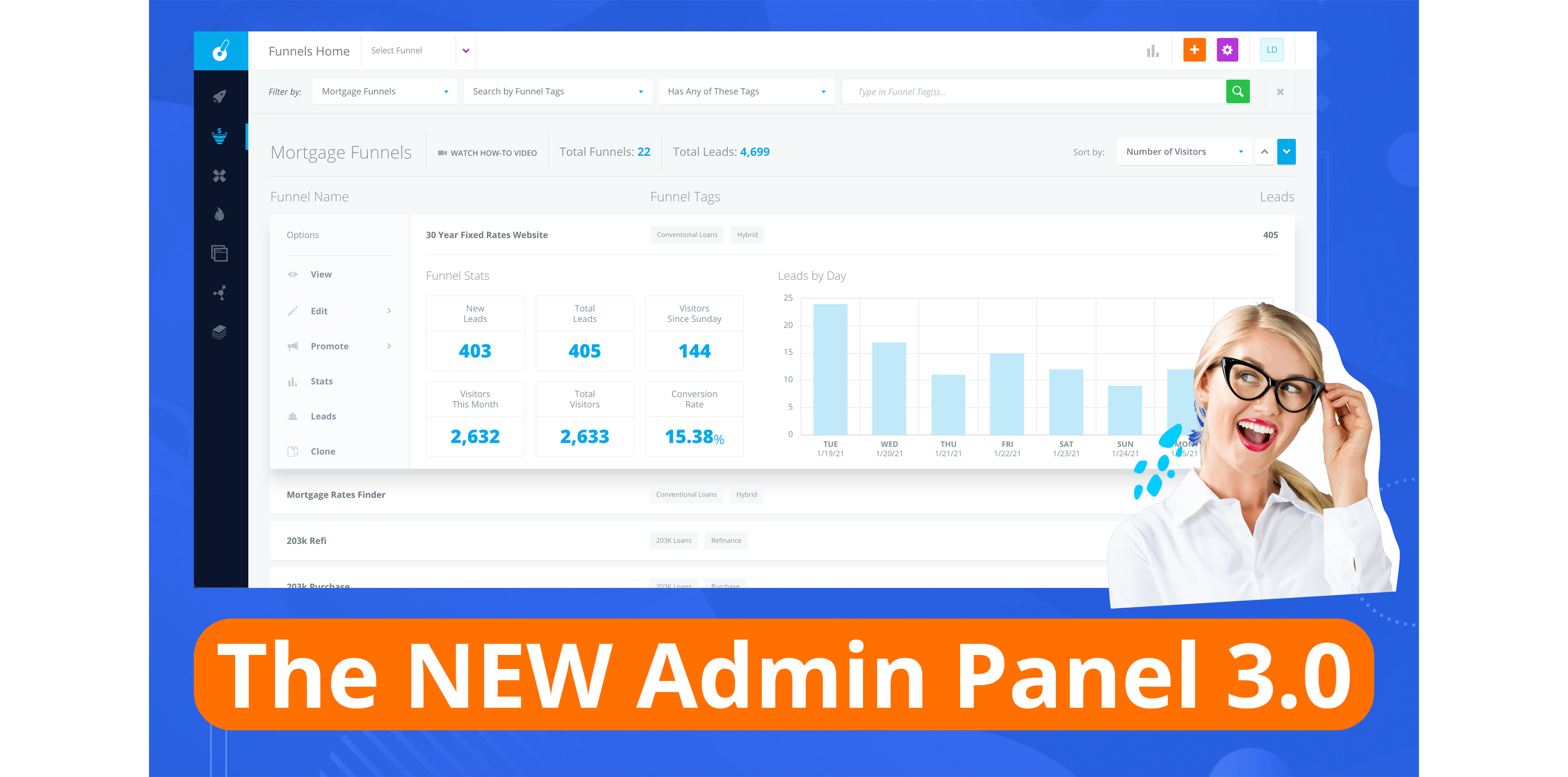

4) Generation of key analytics

Make sure to opt for mortgage CRM software capable of generating key analytics. Usually, these tools store essential information about customers. However, the corresponding information would be useless if not properly analyzed. The ability to generate key analytics promises that customer satisfaction is a prime priority and spreads loyalty among clients.

One of the key analytics is assessing the demographics of the audience living in a specific region. CRM software can assist mortgage brokers in knowing what type of real estate property is most preferred by customers. With the help of corresponding information, they can upsell identical real estate to potential clients. Book a demo from us to understand the significance of mortgage CRM-based software.

5) Software integration

Check whether your chosen mortgage CRM software can integrate with other software. Ask yourself whether you are using accounting tools or loan origination software (LOS). It is beneficial to choose a mortgage CRM software capable of integrating with your existing system. The integration will enhance your business efficiency and ensure that you get clear access to all your data.

6) Cloud support

Currently, most mortgage CRM is stored in the cloud to facilitate smooth collaboration among team members. Unlike traditional CRM, a cloud-based CRM is simpler to implement. It allows the addition of more users rapidly because it doesn’t demand a comprehensive process. Moreover, a cloud-based CRM automatically backs up all the saved data, decreasing the risk of losing vital information. Besides, many mortgage website today come with cloud support for easy collaboration. Request a demo from us to learn more about the usefulness of mortgage CRM software.

7) Affordability

Affordability is vital to consider since it assures ROI in a limited amount of time. Certain vendors promote CRM tools with certain prominent features. However, it can be expensive for smaller companies to pay for those extra features. Using affordable CRM software allows mortgage companies to allot their money to other segments of their business. For instance, they can use their saved money to train more employees to offer improved customer service or prepare more efficient marketing campaigns.

8) Customization

Any mortgage CRM is created keeping in mind the mortgage industry but every mortgage company still has unique needs. Choosing a customizable CRM software makes sure a mortgage broker can modify certain features whenever required. Moreover, it aids them tackle the challenges that mortgage CRM can’t fix. Such mortgage CRM systems also guarantee mortgage brokers that they can handle an increase in users and data.

Conclusion

It is crucial and quite beneficial for contemporary mortgage businesses to choose the ideal CRM software. These tools aid mortgage professionals in handling client relationships, simplify communication, track leads, and even follow up with prospects. The choice of a reliable and efficient mortgage CRM can ensure your business growth. Taking into account the discussed factors will help you choose the most suitable mortgage CRM software.