SEO.

Once upon a time, you didn’t even know what it stood for.

These days, it seems like search engine optimization rules everything you know about getting traffic to your mortgage website and marketing your mortgage business online…

Content, keywords, headlines, social media posts, blogging, email marketing, videos—all that you do flows through the prism of search engines.

And a lot of it will have an impact on your rankings, for better or for worse.

So, it’s not surprising if you make a few mistakes along the way.

SEO is ever-changing, which is why so many mortgage marketers find themselves implementing outdated strategies. If you’re going to improve your search engine rankings and get first page placement, you need to know everything that you’re doing wrong first. Then, you can improve.

Let’s dig in.

Fail #1: Targeting the Wrong Keywords

You’re a small mortgage company based in The Middle of Nowhere, USA. Do you really expect to rank high for a keyword like “mortgage rates”?

The fact is: when it comes to incredibly competitive keywords and phrases like national (and even state-level) mortgage-related search terms, it will likely take you 1-2 years, or longer, to even begin competing—and that’s with consistent work on your website…

We’re talking: immaculate website architecture, lightning fast load times, image optimization, a stellar mobile user experience… awesome, relevant content for days (that you update regularly), and quality backlinks up the wazoo… (just to name a few).

The works.

That doesn’t mean first page placement for ultra-competitive keywords and phrases isn’t possible, it just means that if you’re on a limited budget and you’re not wanting to wait until the next Hale Bopp comet flies by, you’ll have to be more strategic.

Effective SEO starts with accurate keyword targeting.

In short, you have to set ambitious—but realistic—goals.

Go to SEMRush.com and start looking for keywords that will yield you the right kind of traffic—and which you actually have a chance at ranking on the first page for.

Just recently, I looked at stats on a few mortgage searches. Here were some results:

- “California home loans” — 170 Google searches per month

- “California VA home loans” — 90 Google searches per month

That’s the total monthly Google search volume for those keywords.

Not exactly something to write home about, I know.

Then you also have to think: do I really want to compete for “California home loans” with some of California’s top mortgage lenders and lead generation companies… if I’ll only get MAYBE a handful of clicks per month out of it?

If so, you’re a harder worker than I am!

Let’s work smarter instead.

Start looking for long-tail key phrases (keyword phrases that contain anywhere from three to five or more keywords)—like “203K loans in San Diego, CA.”

This is more specific, yes, but that’s why it works! When you add up a couple dozen of these long-tail key phrases and their many permutations, you can start to make a much more significant impact on your search engine rankings and traffic acquisition efforts.

By targeting long-tail key phrases, your chances of placing well for more specific searches goes up as the number of competitors targeting those exact same phrases (usually) goes down.

Not to mention, you often get better quality traffic as these more specific searches yield consumers who know exactly what they’re looking for, and are, many times, closer to the decision-making/purchase process.

Then it’s a matter of providing them with unique, quality, relevant content that will keep them on your website for longer periods of time, and encourages them to come back and share your website with friends and colleagues. More on that in a bit.

Fail #2: Poorly Optimized (or Altogether Missing) Meta Tags

Meta tags aren’t a relic of the past. They’re still used by search engines to get information about your mortgage website.

And when it comes to giving the search engines what they want, it’s usually a good idea to acquiesce.

Start with the Title Tags.

Here, you’ll want to create a website title that describes what your site (or a specific web page) is about accurately—while incorporating the keywords you’re targeting.

It also needs to be consistent with the content of your page—or else Google will know that you’re trying to trick them…

On that note, don’t try to trick Google. Trick Google = Bad.

If you try to cheat, they will catch you, and when they do, it might get ugly.

Don’t believe me? Read this article by Kissmetrics to learn more about Google penalties and how to avoid getting temporarily (or permanently) blacklisted.

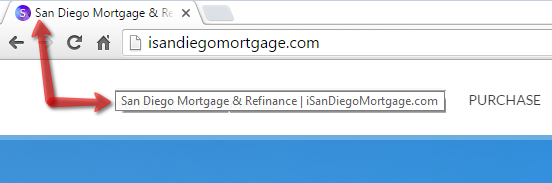

Consider the Title Tags at the “top” of your page. It’s what goes on the tab on your customer’s browser.

And as far as Google is concerned, your page had better be top-to-bottom about that single topic… Otherwise, your website might not show up at all for your desired search phrases.

Meta Tags are important as well: you’re essentially telling people what your page is about.

Meta descriptions used to be one of the more powerful ways to optimize your website, but when people started stuffing them with, “Mortgage, mortgages for me, mortgages for you, mortgages for all…”—you get the point—the search engines caught on.

That’s called keyword stuffing an it’s another no-no.

Now you just want to mention your chief keyword while providing a description that accurately reflects what users will find on the page.

Sure, you’re writing these meta tags for robots, but at some level, you should write as if they’re for humans as well.

After all, if you’re ranking, people can see your website description in the SERPS (search engine results pages), and your description can be the tipping point that entices a potential borrower to click through into your website vs. a competitor’s website.

Bonus Tool: utilize www.moz.com/learn/SEO/title-tag if you want to know more about this basic SEO tactic.

Fail #3: Your Mortgage Website Content Sucks

“Either write something worth reading or do something worth writing.”

-Ben Franklin, paraphrased

At some point, you’re going to want links from other relevant, quality websites to point to your website.

That’s yet another area where quality website content comes into play.

You’ve probably heard of “backlinks”.

Well, quality backlinks are considered to be the most important off-page ranking factor.

The idea is that Google believes if there are a lot of QUALITY links pointing to your website or page from other relevant, authoritative websites, then your site is probably a valuable resource that can be trusted.

And if your website is valuable, Google wants their users to see it when they search for that given topic.

Quick note: I’m emphasizing the word “quality” for a reason—it’s quality over quantity all day long when it comes to your link partners.

Your problem in building quality backlinks? Your content sucks.

I know, I know. That’s harsh. But tell me: am I wrong?

99.9% of the mortgage websites out there have content that will put even the most avid mortgage shopper to sleep.

Many mortgage professionals that are new to SEO assume that if they just put the right keyword at the top of their page, and then lay it on thick throughout their website, they’ll get the results they want.

That might be true for low-volume keywords that have absolutely no value.

But, if you want to compete in the marketplace for highly-competitive mortgage keywords, eventually, you’re going to have to write something that’s engaging, worth reading, sharing, and endorsing.

That’s really what a backlink is: an endorsement from another website.

Here’s what it comes down to:

- Are you writing something valuable enough that people will want to read it? Look at quicksprout.com and consider how much research and thought Neil Patel puts into each and every one of his posts. The least you can do for your readers is to make your website worth reading, with links, tools, and quote request forms to help them along the way.

- Ask yourself this: if you were visiting your website, would you bookmark it? If not, then you know that you have work to do.

How you become compelling depends on your specific angle in the mortgage industry. But don’t fret—there are plenty of ways to be interesting—and you’ll find a tool for just that at the end of this post.

Fail #4: Poor Website Architecture

For example: take a look at the URL you see in the browser at the top of your screen.

Clean, right?

It’s not —

leadpops.com/2017/mortgagetopics/coolstuff/January/myfavoritemonth/post#2300345/blog.html.

That would be an awful way to go about SEO.

No, the URL structure is kept clean and uses relevant keywords that correspond with the title of this article.

That makes the page that much easier for the search engine spiders to “crawl”.

What is a search engine spider?

These “crawlers” are basically software programs that prowl the internet looking for information to gather. If you don’t give them a website with clean, relevant, easy to decipher information, don’t expect to show up at the top of the search results.

The structure of your website’s URLs is just one of many factors pertaining to website architecture.

Additional on-page SEO factors include: quality of code, page security, keyword density, using compressed images that are properly optimized with relevant keywords to describe them, and page load time.

Your mortgage website also needs to be mobile friendly.

These days, 50% or more of your traffic is on a mobile device. In short, if your mortgage website isn’t mobile-friendly, Google won’t be as apt to present your page at the top of the search results.

Fail #5: You Don’t Know Where to Start

I understand that all of this information can be overwhelming.

After all, you’re in the mortgage business. Chances are you put more emphasis on referrals and traditional marketing, like direct mail, than you do online marketing.

But search engine optimization is vital. It’s one of the main ways people find you in this day and age.

Having a well-placed website listing in Google is like having a full-page ad in your local phone book, but with a MUCH larger audience.

If you want qualified mortgage leads for your business, SEO cannot be overlooked.

Back to knowing where to start.

That’s absolutely crucial, and it’s the reason I wrote the book:

The Mortgage Marketing Manifesto: Unlocking the Holy Grail of Mortgage Lead Generation

There, you’ll find similar tips as you see here—but with much more detail and explanation as to how and why things work the way they do in the mortgage marketing world.

Most importantly, you’ll get actionable insights on how to grow your mortgage business that you can put into practice immediately.

Everything is covered: from building your referral base, to mortgage websites and landing pages that convert leads, online marketing, including SEO, PPC, social media, and email marketing, to optimizing traditional advertising to help get you a higher return on every dollar you spend promoting your business.

You’ll even get tactics and scripts to help you build better Realtor relationships. The key is bringing them what they want most: qualified leads. Not hot chocolate and raffle tickets.

All this is covered, and much, much more.

If you need a new mortgage marketing presence to generate more exclusive mortgage leads online, there’s no time like now.

Start a free trial of leadPops to change the way your potential clients see your web presence and start consistently generating leads that convert into funded loans.